Diversification, flexible payloads and OTT – How Global Operators Strengthen Their Positions in the South American Market

Basilio Rodríguez, President of the Federation of Associations and Chambers of Internet Providers of Latin America and the Caribbean, highlighted a new market trend at the FICA forum during the Andina Link exhibition. He noted that previously in-house network infrastructure was necessary to provide telecommunication services. Yet today many countries are switching to neutral network business models through a joint use of infrastructure.

Many operator still fear to lose control of their businesses for this very reason. However, major players choose the path of creating large platforms and systems.

This also holds true for satellite operators occupying large market shares in Latin America. Some of them are starting to widen their presence by offering additional services, including those related to platforms. For example, Hispasat presented at its booth a new ОТТ service rather than the capabilities of its spacecrafts.

This refers to ОТТ platform Wave, which would allow pay-TV operators, internet service providers (ISPs), and content companies to offer their customers high-quality multi-screen entertainment services via Internet without the need to deploy their own infrastructure. Initial investment as well as time to launch the service are thus reduced.

Apart from obvious advantages of South American market with high demand in the corporate sector, implementation of government programs and the expansion of network operators, global satellite operators are attracted by the geographical peculiarities of the region, which allow one satellite to cover several promising markets. For instance, superhigh-throughput Jupiter-3, planned to be launched later this year, will service both the United States and Latin America. Commissioned in 2022, SES-17 will maintain communication with mobile objects in the Caribbean. Some satellites of various operators, in addition to Ka- or Ku-band beams, implement transatlantic trunk communication in the С-band. This kind of approach enables operators to diversify risks and offer attractive solutions in less profitable markets, e.g., in the individual satellite broadband market. Moreover, just like in other local markets, global operators cooperate intensely with local operators and service providers which know the peculiarities of local market. For example, the services offered by Columbian operator of fiber optic networks Integra Multisolutions cover remote underpopulated regions using O3b medium earth orbit constellation. IMS is among the first telecom companies in Latin America to subscribe for O3b mPOWER service.

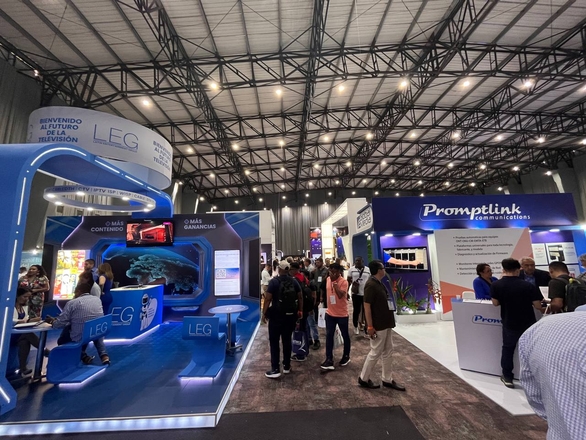

The Andina Link exhibition also showcased conventional services of satellite operators Eutelsat and SЕS. Eutelsat currently focuses on the video market. In an effort to promote the services of its EUTELSAT 65 West A satellite, the operator implemented a program of installing antennas for Brazilian cable operators, enabling a coverage of up to 15m households. Mexican rural schools receive Internet access via this spacecraft under a government program. The EUTELSAT 115 West B covers the territory of both Americas, delivers content to 1.9k high-end stations and 10m households.

The operator emphasizes growing demand for communication in the South American market. In an attempt to satisfy this demand, it ordered Flexsat from Thales Alenia Space with a flexible useful load and a total throughput of 100 Gbps. The launch is scheduled for 2026.

Until recently, the SES-14 satellite was the main resource of SES in South America. In 2022, regional operator Andesat leveraged its capacity to implement general service programs in Chili and Peru. In June 2022, SES commissioned a new spacecraft for North and South America as well as the Caribbean, namely, SES-17 at 67.1° W in GEO.

Successful launch of the first satellites from the O3b mPower constellation allows SES to leverage the benefits of multi-orbit approach with greater certainty.

Traditional American influence on media sphere in the region keeps growing. 2BeNamed, founded by Edgar Spielmann, Marco Ibarra, and Daniel Poblete, three former managers of FOX Networks Group in Latin America, who have extensive professional experience in the TV industry, announced go-to-market for U.S. FOX News as well as trendy channel Insight TV.

The exhibition is characterized by broad representation of European companies, which express a deep interest in tapping Latin America’s market, covering a total of 600 million consumers. France 24 and Deutsche Welle (DW) vigorously promoted their products at the exhibition.

Euronews uses satellites to enter Latin American market. Sarah Mimouni, Distribution Manager & Out of Home at Euronews, said that her company had started to work intensely to deliver content to the aircrafts performing flights in the Caribbean and to deliver Euronews’ products to regional audiovisual platforms. The production and delivery of content for the educational service segment is becoming a separate promising field. The exhibition participants pointed out an actively growing demand for educational and children’s content in the region. For instance, Hector Rodriguez of startup 2BeNamed presented at Andina Link their project KidOO, a pay channel for children aged between six and eleven. Mr Rodriguez emphasized some benefits of the new children’s channel available in the region: “KidOO is a channel without commercial breaks with a large number of up-to-date content for today’s children. We show content from YouTube, yet on a safe private platform, where we know what our children are watching,” he underlined. The channel will operate throughout Spanish-speaking Latin America.

The topic of smart cities has never been raised at Andina Link before. Given that both consumers and market players show strong interest in this domain, organizers do not rule out that it can be detached to form a separate event in the future. For the time being, the countries of the region are exploring the experience of other nations, looking at potentially useful aspects. The greatest interest was shown in issues related to cybersecurity and the employment of smart technologies in healthcare, education, and environmental protection.